Reader question: Emigrate to Thailand and receive a tax-free pension

I intend to emigrate to Thailand and take early retirement. Due to the treaty with the Netherlands, no double taxation may be levied on the so-called income. As it were becomes gross rather than net. If all this is the case, what should be the best way to get my pension money directly into a Thai bank account? Or does this still have to be done through the Dutch bank?

Reader question: Tax obligations in Thailand?

I will be staying in Hua Hin for at least 15 months in a rented condo, and my question is, am I now somewhat taxable in Thailand for some kind of Tax? My TM30 is fine and I don't want any trouble with the Thai administration.

Reader question: Experience with the protective assessment

I recently received the protective assessment via my correspondence address and Mijn Belastingdienst. This was followed by a letter from Heerlen explaining in detail what the attack was based on.

My wife has her own house in Thailand. She wants to sell this house because she will not return to Thailand. Does she have to pay taxes in Thailand when she sells the house?

Income tax return 2019 in Thailand

At the beginning of this year I promised to tell the readers my experience with the Thai government about the income tax return 2019. Also my story about my experience with the Dutch tax authorities regarding obtaining an exemption from wage tax and social security contributions to be withheld from my company pension, as of January 1, 2020. Finally, my fight with the Dutch tax authorities about reclaiming wage tax and social security contributions paid on my company pension for the year 2019 via the IB 2019 return.

Reader question: Who has a standard letter requesting the “deletion” of a protective assessment

Can someone help me with a “standard” letter with which I request to “cancel” the protective assessment. As I once understood, you can / must have that protective assessment "expired" by submitting a request after 10 years.

Reader question: Request for avoidance of double taxation rejected

I emigrated to Thailand in 2006 and live in Chiang Mai. Had me deregistered from the Netherlands and then I am liable to tax in Thailand. In 2005 I received state pension.

Reader question: Taxable due to corona lockdown?

I have lived in Thailand for over 10 years and have been deregistered in the Netherlands for much longer. I live in a condo in Bangkok and, apart from bank accounts, have no assets in the Netherlands. Due to personal circumstances I had to go to the Netherlands with my (Brazilian) wife.

I have been sending monthly maintenance money to my wife in Thailand for years. I can therefore include this maintenance in my (Belgian) taxes. However, for my 2019 personal income tax, the tax inspector asks for 2 extra documents: 1 of my wife's proof of life (which has now been arranged through the amphur) and also proof that my wife is "needy", so that she has no income herself. has. But apparently you don't get a tax statement in Thailand if you have no income.

The qualifying non-resident taxpayer scheme (kbb), which came into effect on 1 January 2015, replaces the option of non-resident taxpayers to be treated as resident taxpayers. The regulation divides non-resident taxpayers into “qualifying non-resident taxpayers” (with tax benefits) and “foreign taxpayers” without these.

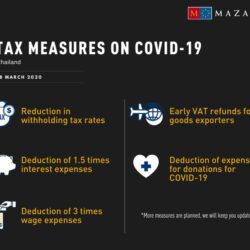

Business tax measures in Thailand due to COVID-19

In Thailand, the government is also taking tax measures for entrepreneurs who are in danger of getting into trouble due to COVID-19.

Reader question: Exemption from payroll tax

Withholding of payroll tax/exemption from payroll tax. Is wage tax and national insurance contributions applied on my tax return?

Reader question: Belgian tax and tax residence

Self-Certification of Tax Residences for FATCA and CRS: Natural Persons. I only have my pension benefits as income and, as a Belgian, who has been living in Thailand continuously for twelve years, I naturally pay my taxes in Belgium. Which country(ies) should I enter under heading: country where you have a tax residence and why?

Reader question: How do I pay taxes in Thailand?

Lately much has been written about paying taxes in Thailand (I have had 2% AOW and a small pension for almost 64 years). Married to a Thai woman for over 16 years. But I am still taxable in the Netherlands. I have tried up to three times in Chiangmai to become a Thai tax resident. But they say you don't live in the city so you have to apply for this in your village (Chiangdao). But there is no tax office there at all.

Reader question: General tax credit

It's time for the annual tax return. Now I have the following question: I lived in Thailand all year 2019. I have also been deregistered from the Netherlands. So I do not pay social security contributions on my ABP pension, but I do pay taxes. Am I still entitled to the general tax credit on the tax component?

Reader Submission: Are We Going to Pay for Our Tax Matters?

Are we going to pay for our tax affairs? Yes, if it is up to Minister Raymond Knops of the Interior! He made this announcement on RTLZ

Reader question: Do I have to pay tax in Thailand on an annuity from the Netherlands?

Soon I will receive my annuity from the Netherlands. This has been done according to Dutch tax rules and you must report the amount to the tax authorities in the Netherlands. Do I now also have to pay tax in Thailand?