Mail delivery and protective assessment, a separate chapter

In an earlier posting I have highlighted the “postal delivery” in Thailand. Has anything changed since then? Unfortunately not!

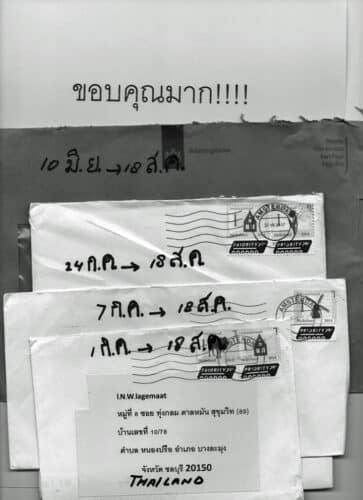

On September 8, I received several mail items, including 3 letters from the tax authorities, which were sent on August 13, 19, and 21. The letter of August 19 was a reminder for late payment of the tax. This should have been fulfilled on July 22! Thanks to the Thai Postal Service for the delay of almost a month! This was demonstrably already paid, but more interesting was the tax letter of August 21.

The protective assessment for 21 was adjusted in the tax letter of 2012 August. I had never had a satisfactory answer to my question about this. Thanks to my tax adviser in the Netherlands, I now had a clear answer.

The tax authorities had assumed that with my final departure to Thailand I had withdrawn my pension from the ABP. They should have known that this is not allowed, perhaps in a private judicial employment relationship. In addition, every year I have to declare my tax income from the ABP. If after 10 years of paying my taxes without any problems, this protective assessment would be nullified. This may have already happened, but I'll check that later.

If one were not very alert to keep track of certain matters, one could get into unnecessary trouble due to the poor Thai postal service!

Lodewijk, one more reason to choose an address in NL for this type of post, which is subject to deadlines. Especially now that you have experience with the Thai post. I don't have that experience though.

My tax and SVB mail went to my brother in NL and he scanned it and then I received it by e-mail. 'Went', because I stopped doing that when MijnOverheid started to run smoothly and I could watch online.

Question: do you not have MijnOverheid, MijnSVB, MijnBelastingdienst? It's a blessing!

Dear Eric,

I have a postal address in the Netherlands and a Digid.

Requested several times to send to the postal address,

but at the beginning of this month the miracle happened!

Another tax letter, but now via my postal address!

Persevere!

Regards,

Lodewijk

Many mistakes are made when reporting a change of address to the Tax and Customs Administration, such as a postal address in the Netherlands. Often, a letter is sent to your own tax office. This is often (when living abroad): Belastingdienst/Office Abroad, PO box 2865, 6401 DJ in Heerlen. However, then you run the risk that eea will not be processed properly.

Please pass on your new address/postal address to the Tax and Customs Administration/Customer Management, PO Box 2891 DJ in Heerlen (for a Dutch address) or PO Box 2892, 6401 DJ in Heerlen (for a foreign address) and not to your own Tax Office. The latter Service draws its information from the central point, namely Customer Management

For an explanation and the address, see:

https://www.belastingdienst.nl/wps/wcm/connect/nl/contact/content/hoe-geef-ik-een-adreswijziging-door

respectively:

https://www.belastingdienst.nl/wps/wcm/connect/bldcontentnl/themaoverstijgend/programmas_en_formulieren/adreswijziging_doorgeven_buitenland

I have exactly the same experience in Spain. And the argument that the ABP does not allow that was not convincing. There had to be a confirmation from the ABP. So a request was submitted (evidence) and then the gigantic attack was cancelled…

Postal items also get lost here... and once even a blue letter is opened. Anyway…Spain is also more Africa than Europe…

The tax authorities also do not want to send anything by email..but that will be known.as well as the reason….

Speaking of sending mail:

I have sent letters from Thailand several times to various authorities.

Almost never any problems.

Now last week I sent a letter to America, registered with EMS.

Cost1350 baht.

But here's the thing: the envelope was sealed with tape and, in case the tape could come loose, stapled with 2 staples. The letter had an appendix also stapled together with 2 staples.

The Thai lady told me that it could be cheaper if I removed the staples from the envelope and the staples from the letter.

I asked the lady, how much cheaper? She said I could send the letter for 800 baht.

I was speechless for a moment.

That 600 baht was quickly earned and the letter even received a special packaging, free of charge.

What a day. Remove 4 staples and 550 baht cheaper. TIT.

I don't understand something I receive from the tax authorities and my government e-mail You have messages in your box and then I can view every letter and every tax assessment We are in a digital age Am 82 but hardly receive any mail anymore. And by the way, what is the problem, the post in Thailand or on the way? Advice pass on your email address to the government, convenience serves man

Dear Jan,

I do not get it either.

Both digitally and the postal address of the Netherlands is known! Other settings work fine with digid.

My tax advisor let me know that the tax return, which I run through him and not

digital submission to the tax authorities is also not answered digitally.

Since last week I have been receiving correspondence from the tax authorities via my postal address, kudos!

My sincere thanks to Lammert de Haan for the extensive information!

Still 1 question. Tax authorities Apeldoorn are mentioned on the giro collection cards sent to send the transfers there. However, I also have a 2nd declaration address for living abroad, which I use.

My mail takes an average of 8 days to reach the Netherlands (by express) and the Netherlands is clearly stated in Thai; conversely "Buddha knows!"

The bottleneck is in the mail distribution center Bangkok!

The postal companies in Laem Chabang, Maprachan and the Sukhumvit Rd post office, which provide further care, are also not happy with that!

Hello Mr Langemaat,

Don't mention it. That's what Thailand Blog is meant for.

I suspect that the comment that your tax advisor does not submit your return digitally (and therefore on paper) is based on a misunderstanding. That would be pure job creation.

He may use private software instead of the Tax Authorities' tax return program, which means that you cannot consult your tax return digitally (via “My Tax Authorities”).

You also write:

“The Apeldoorn tax authorities are mentioned on the giro collection cards sent to send the transfers there. However, I also have a 2nd declaration address for living abroad, which I use.”

To avoid a misunderstanding: the Apeldoorn office is not your tax office/declaration address. Most likely this is the Tax and Customs Administration/Office Abroad in Heerlen. You submit your tax return there and they will process your tax return, determine the assessment and settle any objections

The Apeldoorn office was largely dismantled a few years ago and is now the national administrative center for payments. In addition to this administrative function, the Center for Application Development and Maintenance is also housed there. Virtually all regular tasks of a tax office were then transferred to the Arnhem office, with the exception of the reimbursement of incorrectly withheld income-related contributions to the Healthcare Insurance Act. That task has been transferred from the Apeldoorn office to the Utrecht office.

In short: for filing returns, etc., you only have to deal with your Tax Office (most likely the Foreign office).

You pay or receive money back via the bank account of the Tax Authorities in Apeldoorn.

Thanks for the response!

Both my tax advisor and the undersigned arrange everything digitally.

My tax return is not submitted digitally or in any other way to the call service by me, but to my tax advisor.

As a result, I cannot consult my tax return (my tax authorities) digitally.

Regards,

Lodewijk