Thai households deepening in debt

(Pavel V. Khon / Shutterstock.com)

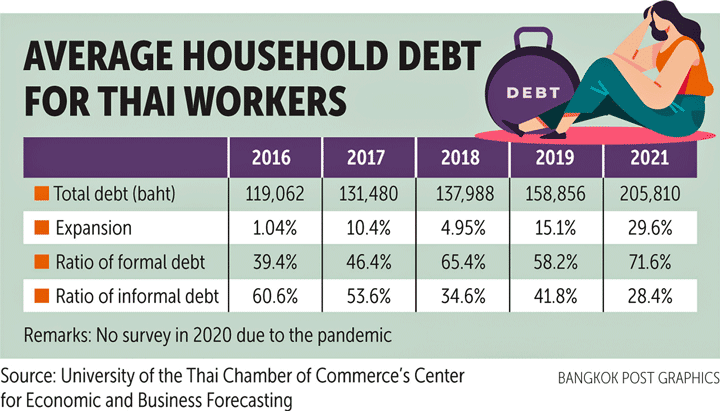

The average household debt of Thais with a paid job shows a historic increase. This has therefore increased by almost 30% to approximately 205.000 baht in 2021 (compared to 2019). The main cause of this is the corona pandemic, according to a survey by the University of the Thai Chamber of Commerce (UTCC).

The survey, conducted April 18-22 by the UTCC's Center for Economic and Business Forecasting, had 1.256 respondents nationwide. The respondents had less than 15.000 baht in monthly income.

The survey is conducted annually, except in 2020, when the lockdown prevented the survey from being conducted. In 2019, average household debt was 158.855 baht, up 15,1% year-on-year.

Thanavath Phonvichai, president of the UTCC, said 98,1% of respondents have household debt, up from 95% in 2019. Many Thais have to take out loans for day-to-day expenses and old debt repayments. About 67,6% of respondents said they had no savings.

The country's economic condition is of the most concern to respondents, followed by the Covid-19 situation, lack of access to vaccines and product prices. About 85,1% of respondents said they had difficulty repaying debt in the past year due to lack of liquidity, high costs, a disparity between income and expenditure, unemployment and the economic downturn.

About 71,5% said they struggle with the fact that their income is lower than their expenses. Formal lending is the most commonly used option to address this problem (47,2%), followed by informal lending (13,6%), sale of assets (12,3%), use of savings (12%), seeking help from relatives (9,6%) and looking for additional work (5,3%).

A whopping 86,1% of respondents want the government to help alleviate debt, such as suspension of loan repayments, while 14% want the government to lower interest rates. To help cover living costs, a co-payment scheme at 41,3% is the most preferred option, including the Rao Chana (We Win) scheme.

Source: Bangkok Post

If the government ever had to start tackling those people who give illegal private loans to usurious interest. But as usual these people are in better circles and will never be touched.

Jan, the government has already started a dozen times and there are also rules in Thailand, but yes, rules are sometimes forgotten…

In the past, the excesses have been dealt with as with loan sharks (yes, there is even a word for it) who kept goons. People have already been mutilated for that money, but the loan shark phenomenon is still there. And apart from the usury, this phenomenon is also necessary in a poor community. Where else will the minimum wage earner in Thailand get a loan if there is no collateral? Medical expenses, buffalo death, damage?

Mopeds are often borrowed through the garage and then there is collateral. Land can also serve as collateral. But if you have nothing? Do you give a Thai a loan purely on his brown eyes? Just read the comments here if someone brings it up…

Corona is adding another shovel. Many jobs gone, but there still has to be rice on the shelf. Get on it!

You worded it well, Eric. Those debts are almost always for urgent expenses. Because the costs of borrowing are high and sometimes cannot be paid, many farmers lose their land. I hear a lot of sad stories from Thailand.

Tino there are a lot of them who seriously live beyond their own dstans. When I see in my wife's village where husband and wife together earn 20000 THB and their salary is almost entirely spent on the loan from the Toyota Fortuner, I am not surprised by those problems. My wife's nephew's job is to collect money from the defaulters. He himself says that it is mainly about people who live beyond their means and at the slightest setback, for example loss of work now in corona times, they are in serious shit.

Of course, in Thailand there are people who live beyond their means and people who gamble. Half of the debts in Thailand are mortgages, a quarter vehicles and the rest all sorts of other things, many for their profession, such as seeds and fertilizers. School fees, weddings and cremations.

In the wealthy Netherlands, 5 percent of households have payment arrears and 10 percent have problematic debts. I don't think that the average debt of 200.000 baht is terribly high. It will be roughly equivalent to a household's annual income. The main problem is that many households do not have access to relatively favorable debt from a bank, but depend on loan sharks who charge 20-50 percent interest per year.

Dear Tino, I know two loan sharks in my village and two in Bangkok. None of them are concerned with annual interest rates. The common rates are 10-20 percent per month and not per year. I don't know if they have customers but I suspect they do.

You are right, JosNT, I have also seen those amounts. Also depends on the collateral, such as a chanod.

“According to Mr Thanavath, the slowing economy resulted in lower incomes, with daily wage employees the group at the greatest risk. This group has been forced to rely more on borrowing from loan sharks to cover their daily expenses.”

Thais who have to borrow money for their daily living means, in my opinion, that these Thais live beyond their means. I know enough in my own area: not 1 but 2 cars and also a moped, but problems with buying food. It involves the wrong priorities and show off with your property.

In another response, someone says that the Thais must have a car because their work is 60 kilometers away. that is not according to me the law of the Medes and Persians. I traveled 5 kilometers a day on public transport in Bangkok for about 55 years to get to my office. Sometimes 1,5 hours, sometimes 2 hours one way. Finally I decided to move. Thais can also do that instead of buying a car, but apparently it does not occur to them.

Furthermore, I do not believe the results of debt among the Thais very much. It takes quite a bit of time to measure this properly and completely (that is certainly not possible by telephone; many loans do not have papers) in addition to the fact that Thais feel some hesitation to confess all debts. And: a number of unpaid 'loans' are no longer felt as debt because they have not been repaid for months or even years and the lender has despondently decided that he/she will never get the money back.

I am one of those lenders.

Quote:

'Thais who have to borrow money for their daily living means, in my opinion, that these Thais live beyond their means. I know enough in my own area: not 1 but 2 cars and also a moped, but problems with buying food. It's about the wrong priorities and show off with your property.'

Yes, there are people who live beyond their means, Chris, but that's not the majority. In my experience, most debts are caused by often unforeseeable socio-economic circumstances, such as loss of a job, a failed harvest, a bankrupt small business, a divorce, a cremation, etc. Husband and wife both have a good job and are quite capable of afford a vehicle and then something happens… Really not that much different from the debt problem in the Netherlands.

The debt problem in Thailand is really not comparable to the debt problem in the Netherlands. Comparing figures of the level of debt is number 1, looking for the characteristics, causes, processes and solutions is number 2. And then I see:

– that there are not many or insufficient financial guarantees or assets against debts in Thailand;

– that banks are way too generous in lending and credit cards (it is cutting back a bit). People in my neighborhood live on less than half of my income who have 2 credit cards and more than 1 loan. Take a look at the percentage of non-performing loans from banks in both countries. If someone guarantees the payment of the loan or credit card, it is usually provided. VRgo, no questions;

– a decline in income in Thailand actually immediately means a major financial problem, not only for the person in question, but also for other family members who now have to step in and therefore often also get into financial problems. One family member can ruin an entire family. I have seen in Thailand but not in the Netherlands;

– graduates who have not repaid their student loans for decades now and the government who does nothing about it either. Now people have woken up and that causes outrage. Well I ask you. See: https://www.bangkokpost.com/thailand/general/2079091/student-debt-repayments-drop-to-100-baht-a-month

– an accumulated debt burden means a problem for years and for the short-term thinkers who are generally Thai, hopeless. How many suicides in this country are related to debt? But also looking for a lot of short-term income that is usually earned in the gray or black circuit: gambling, drug sales, all kinds of shady dealings in products (my wife just happened to receive an eau de toilette made in North Korea as a gift this week) .

– the research you quoted says that about 20% of debt is built up in whole or in part through informal (sometimes criminal) organizations. Those organizations do not ask for pay slips, but for interest.

– the ordinary Thais who have somehow collected some money also play bank for friends and acquaintances. Never experienced that in the Netherlands.

No, the debt problem in Thailand is of a completely different order than in the Netherlands.

That's a good summary of the research, the results of which can be found here:

https://cebf.utcc.ac.th/upload/poll_file/file_142d27y2021.pdf

Well taped in Thai with some results.

This study was about persons with less than 15.000 baht income per year.

Last January there was a survey of all households. There, the average debt per household turned out to be 484.000 baht.

https://www.bangkokpost.com/business/2049335/household-debt-rises-42-to-12-year-high

the banks also make golden profits thanks to the loans they give. How so? They themselves borrow from the National Bank at a low rate (as far as I know: between 1 and 2%) and lend the same money at percentages that are 15 to more. Checkout! If a maximum could be set up there…but of course that is not possible, because we know the bank owners

Dear people,

I think what is happening in Thailand is also happening in the Netherlands. Due to the low interest rates, households can borrow more and more. House prices have risen on average by up to 40% in the last 5 years. Not wages. or insignificant. As soon as interest rates start to rise, the bomb will burst. And of course, income due to the covid-19 pandemic is also being significantly reduced for many. Taxes go up Jan with the cap will be caught on both sides in the future. At least by the bank, but also by the government.

Regards Anthony

Antony, what idiot takes out a floating rate loan in these super-low interest times?

I don't know where the research was conducted, but when I look at various people in my area, the problem is that they live beyond their means. Maids, motorcycle taxi drivers and security guards are not afraid to gamble 25% of their income on the underground lottery. Add to that the fact that the males also have an urge to drink a few beers and that gambling on football is also quite popular and that a household must also be maintained.

Putting the money to the business is apparently not for many people, so I'm curious how many people who are serious about their finances actually have a problem.

Spending is not that difficult and asking for money has become an art without being ashamed of it. The latter to shame yourself is perhaps a Dutch trait, but rather that than having to bother someone because of your own failure.

Give 10.000, 20.000, 30.000 or 40.000 per month, it doesn't matter because there is always a shortage.

may I give you a VB in my own family brother-in-law works as a responsible person in a hospital (permanent job) and his wife is a teacher (permanent job) together have 40000 baht/month have to pay for a house 15000/month and a car 10000/month is, by the way, indispensable work. located at 60km, what remains ???

Count the food 10000 / month and I am not talking about dental visits or children's clothing and impossible to build up a reserve for "later" that is different from your statement of quote:

Maids, motorcycle taxi drivers and security guards are not afraid to gamble 25% of their income on the underground lottery. Add to that the fact that the males also have an urge to drink a few beers and that gambling on football is also quite popular and that a household must also be maintained!

just taken from life, and that is a "middle class family" how are the workers doing and how many???

Do you know that a wage laborer works 12 hours a day both in the fields for a scrap wage and isn't it true that they don't have daily work?

@Pratana,

I was talking about the situation in Bangkok and about people who just have permanent employment. Saving money is done by spending less than comes in and, above all, not making senseless expenses, and if that means driving a second-hand car, then so be it. Moving is also an option, as is choosing to have children. Children cost money for 2 years and if you don't have that why have children? Put that savings aside for 20 years and you no longer have to worry about whether your child is willing to pay that 20 baht per month. Wanting to have everything is never going to work and is a recipe for lasting misery.

The debts of the farmers have a different cause and unfortunately, as a professional group, they let themselves eat the cheese of their bread, but that problem also exists in the Netherlands. A society focused on cheaper, cheaper does not make for a better world, on the contrary, consumers who go for the cheapest are responsible for the deteriorating state of this earth and its inhabitants.

And meanwhile you still see commercials everywhere about how easy it is to buy a big car, expensive moped or whatever.

Car for cash, home for cash etc etc etc.

Many advertisements no longer even state what the product actually costs when paying in cash, but how much you have to pay down and pay off the rest later.

And don't forget the free toaster or rice cooker that comes with it.

Make your dream come true isn't it.

But for now, Dutch Jantje is still driving his now 17-year-old Mits, without any headaches.

Jan Beute.

Hi Jan,

Just for your information, ordered a new BMW X5 last month. Not cheap I must say. Everything paid in cash, no loan. I have to be honest, that free toaster convinced me 🙂

Just kidding, we might laugh about it, but all those debts that many Thais take on is the sad reality. Not much should go wrong (such as the current Covid crisis) or many Thai families will run out of money to buy food halfway through the month.

Yesterday I went out for dinner and then some shopping. Virtually no customers. The economy is pretty much flat here. I'm afraid if this doesn't change quickly that some dramas could happen.

I regularly read here that the Thai has no worries and lives from day to day ... Right, so you see. They have no sense of standards whatsoever, looking to the future is pointless. Saving a little, oh dear, they don't know that. Earned 1000 THB today, tomorrow this money has already been spent. Even better, within 2 months they have an end-of-year bonus, but today they are already pro-actively spending this money. I've always learned to save first, spend later. I have not yet come across a single Thai who uses this principle. Sorry I'm lying a bit, my wife does this now but probably because she can afford it. The banks must be super rich here…

On average, Thais save 1.500 baht per month. 52% save for old age, through their formal jobs or a kind of 'life insurance', many save into a kind of 'village fund' (50-200 baht per month) for things like cremations and other sudden expenses.

Half of Americans (one of the richest country on earth) have less than $1000 in savings.

See this video:

https://www.youtube.com/watch?v=sOLbfDX_MfU

I don't think the problem is a different kind of attitude towards money and spending (for a small percentage, yes) but simply the low income and the large inequality in income and wealth.

Right Tino, I agree with you.

I can't help but say a word about saving in a kind of "village fund". A neighbor became a widow 5 years ago. She is 74, naive, lives alone, can neither read nor write and has poor health. If she doesn't feel well she also sleeps with us. I call her my mia noi. We eat together regularly and every month I take her by car to the hospital 30 km away for a check-up.

She had also been saving monthly in a village fund for years. Two years ago, she requested that credit (about 26.000 THB) because she wanted to replace the power lines in her house. She replied that it had already been paid. My wife intervened and found out that it was paid to a neighbor of the female who lives 50 m from her (and has debts throughout the village and beyond). And if she wanted her money, she had to arrange it herself with the neighbor. My wife then threatened to file a complaint against the person who made the payment. Two weeks later it was all right and she got her money.

The savings you are talking about is the contribution of both the employer and employee because of Social Security. Maximum 750 baht per month for the employee. Suppose you manage to make a payment to the SSO for 30-40 years, then the saved is a maximum of 720.000 baht, half of which the employer has paid, or not independently saved by the employee. Then you can live another 10 years and entitle you to 6000 baht per month, which is not indexed after 40 years.

I really can't see that as saving. Saving is actively caring for yourself to obtain more wealth.

It is also not a savings, but a contribution to a fund that is used for various things; 100% health insurance, death and disability insurance, provident fund (pension) and unemployment or retirement benefits

My girlfriend and I never go into debt.

Always pay everything in cash. New BMW or old box. Does not matter.

Debts are touted as wealth, while the beautiful saying: 'Owning the thing is the end of the entertainment' is always forgotten.

That is the case all over the world. I am sure that the mountain of debt in rich countries is much higher.

In the Netherlands, an average house now costs more than 4 euros. That's a million guilders. My 33-year-old son has a loan of 1 euros for a workers' house in the polder. 25 years ago I paid 97 guilders in Axel for a shop with a house. My son is single while I was able to support a family.

Since 1995, the world has been on the drip of fiat money and with figures like Dragi from City bank it is only accelerating.

In Thailand they now ask more for a rai of agricultural land than in the Netherlands. Along the road from Korat to Phimai construction is going on as if it can't go on, but there are few people in the shop.

Let's hope that the energy transformation is a real option against the overconsumption of rubbish.

Modern slavery. Does anyone remember Allen Greenspan who had helicopters scattered with money from Europe across the USA .. we are now paying for that.