Tax treaty Thailand – Netherlands

Much (too much) has already been written about the taxability of income in Thailand by foreigners, in particular pensioners of Dutch nationality. So I risk all kinds of reactions right or wrong.

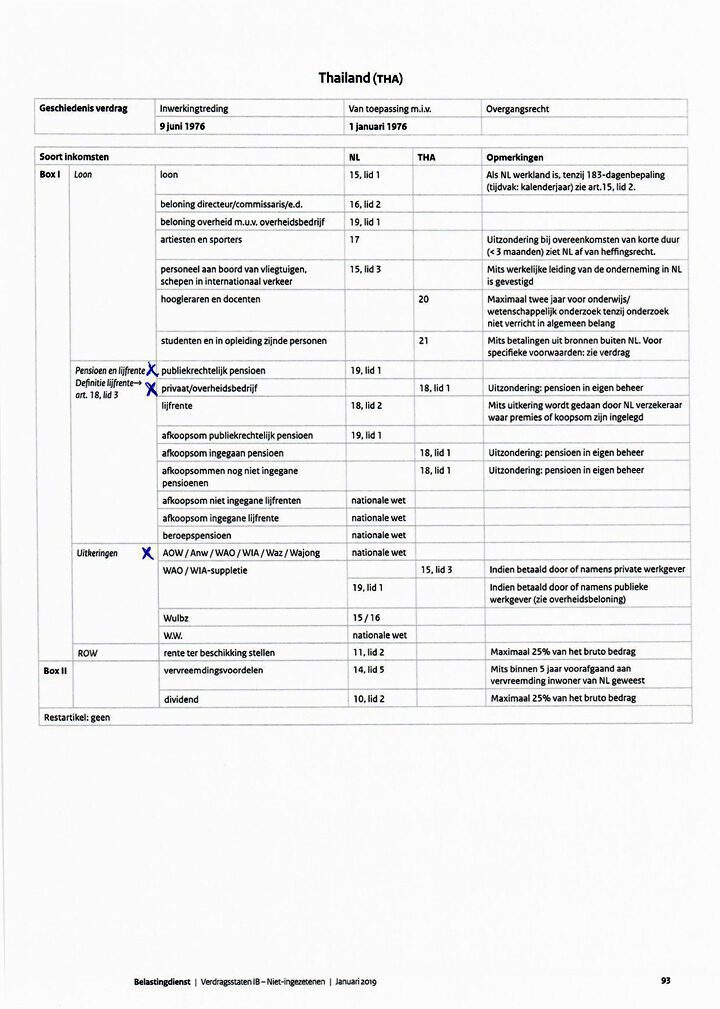

Here we go. The treaty between Thailand and the Netherlands can be summarized in the table below from the Dutch tax authorities. From January 2019! So it couldn't be more reliable.

It really only needs some explanation on 3 points.

- Where the NL column contains an article number, the Netherlands is taxable, where the TH column contains an article number, Thailand is taxable. Where state national law, both countries can levy.

- Public-law pension, ABP for government employees is therefore always subject to Dutch tax and the Thai service is not competent.

- AOW etc can therefore be taxed by Thailand. If Thailand does so, the taxpayer can apply to the Dutch authorities for exemption from taxation for that part of their income and possibly request a refund of tax already paid for previous years. Maximum 5 years ago.

If you want to check the article text, google "Treaty States IB Non-residents" and you can download the entire treaty.

Whether you will be treated according to this scheme in the event of a discussion with the Thai service depends on regional views and expertise. If there is lasting dissatisfaction, the Thai tax office in Bangkok can offer a solution.

Hi Klaas,

AOW is taxed in the Netherlands and not in Thailand, see your table. Perhaps written too hastily.

Hank ,

I think Klaas just explained that where it says nationally, both countries can levy it, so if you have it levied in Thailand, the Netherlands will have to take a step back.

That the AOW benefit would not be taxed in Thailand is a common misconception. I pointed this out on March 21 in Thailand Blog at the topic recently in Thailand Blog at the topic: "AOW taxed or not in Thailand."

The double taxation treaty concluded with Thailand makes no mention of social security benefits. And in the absence of a treaty provision, both countries may levy tax on such income. Both the Netherlands and Thailand apply the principle of taxation of worldwide income, unless they enjoy treaty protection. The Netherlands then levies as the source country and Thailand does the same as the country of residence, provided that this income is actually contributed to Thailand in the year in which it is enjoyed.

Subsequently, in the Netherlands, the Double Taxation Decree 2001 can be invoked, after which the Netherlands grants tax relief up to a maximum of the tax due in Thailand. In addition, this reduction will of course never exceed the tax due in the Netherlands on this benefit.

Negotiations are taking place this year with Thailand for the purpose of agreeing a new treaty. It is likely that such a new Treaty will fill this gap. But it will be several years before a new Treaty comes into force.

that means, I think, that it makes no difference whether it is taxed in Thailand or in the Netherlands.

After all, Lammert writes, “after which the Netherlands granted a tax reduction up to a maximum of the tax payable in Thailand.” So if you pay less in Thailand than you would pay in the Netherlands, the Netherlands will levy the difference. Result: you pay the same as if the Netherlands had levied a levy.

There is no mistake in my diagram and the explanation. Lammert is absolutely correct. See also “Taxing AOW abroad” under the SVB. It can be beneficial to tax the AOW in Thailand. By deducting it from your tax return in the Netherlands, you pay a low amount in Thailand, depending on the state pension, if you are standing alone or cohabiting. For cohabiting, there is first a deduction of 190000 banht because you are older. The remaining part is taxed at 5%. In addition, your income that remains taxed in the Netherlands can decrease by a tax bracket. Individual search can be very profitable.

success

Sorry not correct my previous post

Why should I pay my taxes in Thailand.

They are already asking 800.000 baht to have on your account that you cannot reach to apply for a visa. I do pay my tax in the Netherlands as a matter of principle

Dear Co,

If you receive a company pension, do you also pay income tax on this pension in the Netherlands or do you mark it in the tax return as being taxed in Thailand?

In principle, Thailand is allowed to levy on this (Article 18, paragraph 1, of the Treaty for the prevention of double taxation concluded between the Netherlands and Thailand).

If you do pay in the Netherlands but not in Thailand, your principle will cost you a lot of euros.

Incidentally, I do not agree with this principle: in the Netherlands you do not use any facilities. You have to rely on Thailand for that. The Netherlands then enjoys the benefits, but Thailand the burdens!